Step into 2025, and the Turkish property market — as charted by the portal Turk.Estate — doesn’t so much unfold as it unravels, pulsing with contradictions, recalibrated ambitions, and techno-optimism. What looks like a bull run from a distance begins to shimmer on closer inspection, distorted by inflation, regulatory tremors, and the unpredictable tempo of foreign interest. It’s not just about square meters anymore — it’s about digital dominion, shifting center points, and finding signal through the static.

Under the Hood: Prices Surge, Value Slips

The topline? Nominal housing prices in Turkey leaped by 31.95% in the twelve months leading up to January 2025. That’s not a typo — it’s a dizzying year of growth. But step back, factor in a searing 64.7% inflation, and what you’re really looking at is a –7.16% drop in real value. A currency racing to devalue faster than bricks can appreciate. The illusion of gains melts under macro pressure.

By June, the average residential property price had climbed to $825 per sqm, up from around $630 the year prior. On paper, it’s bullish. In reality? A mirage for unhedged investors navigating a deflating lira.

Market Snapshot (Jan–June 2025)

- Nominal Price Growth: +31.95%

- Real Price Shift: –7.16%

- Avg Price: $825 USD/sqm

And yet, the market pulses with activity. Over 335,000 homes changed hands in Q1 — a 20.1% spike in domestic sales. Foreign interest, however, receded. Just 574 homes were sold to international buyers in March, down 11.5%, hinting at nerves or noise — or both.

Yield Frontiers: Where the Math Still Works

In a climate where capital preservation is no longer a passive sport, yields have taken center stage. Rental returns now function as lifeboats — steady, local-currency-based income in a sea of volatility. And in 2025, Turkey’s rental yields don’t disappoint.

| City | Avg. Price (USD/sqm) | Gross Yield (Q1 2025) |

|---|---|---|

| Turkey | $825 | 7.41% |

| Istanbul | $1,256 | 7.30% |

| Antalya | — | 5.73% |

| Izmir | — | 7.10% |

| Ankara | $748 | 8.67% |

By Q3, the national gross yield had inched up to 7.76%, a modest but telling move. Buy-to-let remains king — less sexy, more stable. In Istanbul’s fringe neighborhoods undergoing rapid revitalization, some value-add plays are clocking 12%+ IRRs, especially where smart refurbishments meet rising rental appetite.

Coastal enclaves like Antalya continue to seduce with 8–10% short-term rental yields in high season. But that sugar rush comes with its downsides — seasonality risk, regulatory unknowns, and property management overhead.

Ankara Rising: The Quiet Giant Awakens

While Istanbul grabs headlines, Ankara is staging a quiet coup. For the first time in years, Turkey’s administrative capital is stealing the investment spotlight. Luxury properties saw an 18% price climb in 2024. The city’s housing price index stood at 182.38 by May 2025 — a 32.3% YoY increase. Translation: growth that isn’t just fast, but sustainable.

At $748 USD/sqm, Ankara property for sale remains eminently affordable. What’s more, gross yields sit at 8.67%, outpacing larger cities. It’s value, wrapped in stability, laced with growth.

Why Investors Are Turning to Ankara

- Massive Metro Expansions: New lines extend into Çankaya and Etimesgut — bringing foot traffic and rental demand with them.

- Low-Cost Entry: Properties under $80,000 are still plentiful, and many yield 9%+ gross.

- Enduring Demand: Civil servants, academics, and students ensure long-term occupancy without speculation spikes.

Digital Dawn: PropTech’s Quiet Revolution

The buzzword of the year? PropTech — and it’s not just a gimmick. The old guard of Turkish real estate is digitizing, quickly and decisively. Globally, PropTech spend has hit $41.5 billion, and Turkey is no longer watching from the sidelines.

What’s changed?

- VR & AR Viewings: Virtual tours have trimmed transaction times by 20%. Foreign buyers click before they visit.

- AI Valuation Engines: Smart algorithms now digest transaction histories, zoning patterns, and renovation permits to spit out real-time property values — no appraiser required.

- Blockchain Registries: Antalya is testing digital land titles. Result? A 40% drop in closing delays.

It’s not just about automation — it’s about trust. Transparency is the new currency, especially for overseas buyers navigating from afar.

Regulations & Realities: Know the Terrain

For business-minded investors, understanding Turkey’s evolving regulatory landscape is mission-critical. While the door remains open, the rules are shifting underfoot.

- Citizenship by Investment: Buy above $400,000 USD and you’re eligible. This pipeline continues to draw deep-pocketed buyers from Asia and the Gulf.

- Foreign Ownership Caps: New zoning laws restrict foreign purchases in high-demand urban districts like Beşiktaş and Şişli. The government is dialing back speculative flames.

- Mandatory Insurance: Earthquake (DASK) and health insurance are now legally required — they add cost, but reduce downside risk.

Taxation, always the moving target, has seen recent carrots — reduced transfer fees, VAT exemptions — for select investment-grade developments. But don’t expect it to last forever.

On the Horizon: What Lies Ahead

What’s Hot

- Green Standards Go Mainstream: New buildings aren’t just stylish — they’re certified. LEED, BREEAM, solar panels, geothermal pumps. It’s not luxury — it’s standard.

- Smart Buildings, Smarter Budgets: Predictive AI systems monitor plumbing, wiring, and insulation in real time — preventing meltdowns before they happen.

- Global Buying, Local Living: End-to-end digital transactions make Anatolian and Aegean properties as accessible to a buyer in Frankfurt or Doha as to a local realtor.

What Could Break

- Lira Whiplash: Currency swings remain a dealbreaker. Without hedging, even a high-yield rental becomes a net loss.

- Political Tremors: The shadow of upcoming elections looms large. Shifts in policy could hit zoning laws, tax perks, or foreign ownership thresholds with little warning.

- Luxury Overkill: High-end oversupply is a slow-moving risk. If it hits, expect sharp corrections. Core-plus assets with solid fundamentals are the safer bet.

Conclusion: A Market in Motion

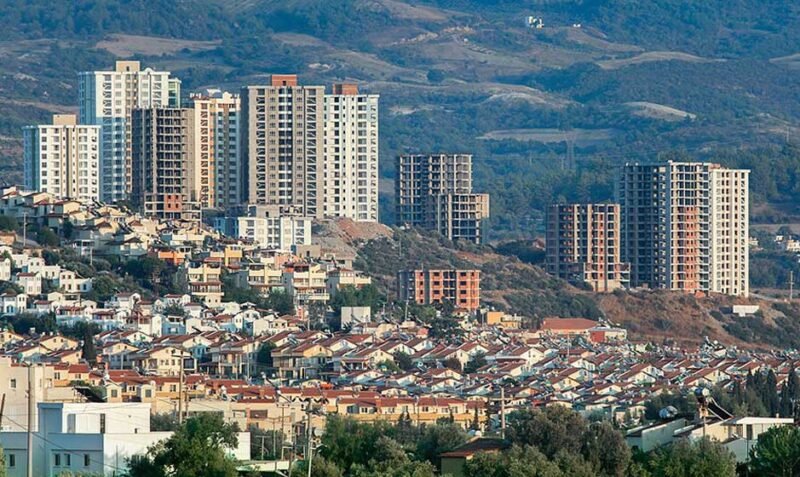

Turkey’s real estate sector in 2025 is not for the passive or the faint-hearted. It’s dynamic, contradictory, and endlessly recalibrating. The opportunities? They’re real — from modernist apartments in Istanbul’s emerging quarters to affordable villas tucked into coastal hillsides.

But success here doesn’t come from luck. It comes from knowing the rhythm — when to enter, what to avoid, and how to adapt. Yields remain attractive, tech is unlocking access, and new cities are entering the conversation. For those willing to navigate its complexities with precision and patience, Turkey’s real estate market doesn’t just offer return — it offers reinvention.